It’s been a while since I’ve talked about health sharing–almost a year, in fact. Last summer, I was still comparing the offerings, but can now offer some insight into my own experiences. I’ve also been compiling the financial stats sent each month to Liberty HealthShare members. This month includes a few tweaks to the reporting that make the internal operations much more transparent.

Using the Membership Card

My first real experience using Liberty’s program was in going to see a provider for a physical. I presented the card, got the physical, and waited for bills to arrive.

Even before they did, I had a notice from Liberty explaining the bill–very much like an Explanation of Benefits that you’d get from a traditional insurer. It listed all of the charges, with adjustments to get to the rate schedule the provider accepted when they submitted their bill. What rate schedule is that? It’s right on the card:

Group does not use a PPO network. Reimbursement is determined in reference to Medicare allowable amounts (150% for physicians, 160% for inpatient, 170% for outpatient) or, in absence of applicable CMS fee schedule, in accordance with Sharing Guidelines. Acceptance of Group sharing payment for Eligible Expenses constitutes waiver of Provider right to balance bill patient.

In other words, the rate schedule is a multiple (150%-170%) of Medicare rates. The portion of the bill that exceeds those rates is waived just as it would be if you saw an in-network provider on a PPO plan–they won’t seek payment for the amount above the agreed-upon rate schedule.

When I examined the provider’s bill, charges totaled $863.15. The rate adjustments brought the total to $141.27, which was shared by Liberty. The provider was paid on December 20th, for service billed October 13th–a little over two months. Included as part of the sharing benefits for preventive care, I paid nothing for those services.

Submitting Medical Expenses

In another instance last fall, I went through the process of getting a flu shot (for the first time in at least 25 years) and another 3-dose vaccine. A relative had been the recipient of a stem cell treatment as part of a fight against cancer. He’s just about to the point where he’ll be restarting all of his childhood vaccines–but over the holidays, that meant he had the immune response of an infant, but the disadvantage of being much older. Those of us visiting over the holidays had to take special precautions for his health.

I stopped in at a small Kroger Pharmacy–the same Kroger you’re familiar with, but a store smaller than a typical CVS or Walgreen’s. Think pharmacy counter, greeting cards, and not much else. The clerk wasn’t sure what to do with the Liberty card, given that it wasn’t in Kroger’s computer system. They had the shots I needed though, so I went ahead and paid directly.

Receipt in hand, I logged in to Liberty’s online portal to explore the process of submitting a bill myself. Turns out, it was as simple as entering the date of service, amount of the bill, and attaching a receipt image. I included a short description of what I received, “flu shot”, and the bill was submitted.

Thirty days later, I had a notice of payment, and a check in the mail. Easy enough.

Financial Reporting

One of my reservations about health sharing in general revolves around understanding how effective they are at meeting the needs of their members. Most have very little information about that online, other than how long they’ve been in operation. Since they aren’t traditional insurance underwriters, their financial health isn’t subject to various state financial requirements and disclosures.

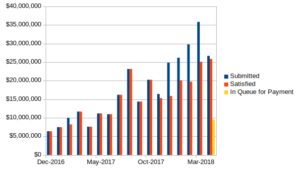

Of course, part of what makes it all such a good deal is that they’re not spending piles of your premium dollars doing administrative stuff for the government. Through November of last year, the eligible medical expenses submitted were roughly in line with what was shared (i.e. paid).

Shortfalls

With the monthly newsletter reporting December’s stats, there was a noticeable difference. The eligible expenses submitted exceeded the amount shared by almost $9 million. There was a note included in the newsletter pointing this out, and drawing attention to expected increases in expenses at year’s end.

In February, however, the deficit continued. Liberty included a note about keeping an eye on it, and reminded members that their own medical care choices have an impact on the pool’s finances. Seemingly, through March, there was a significant shortfall in sharing relative to expenses that were eligible for sharing.

But the May newsletter (reporting April’s numbers) shed a little more light on how things work. Liberty added a little more detail to the reporting, and dispelled my assumption about how they’d deal with a shortfall.

What I’d Assumed

Without much basis, I’d just made the assumption that if the pool of money in a given month wasn’t enough to share all expenses, that the claims submitted would be prorated and paid proportionally. It seemed logical at the time, and looking at claims history, was sufficiently adequate to satisfy me.

What Actually Happens

With the changes to the reporting, you can see that they pay claims as the funds become available. Instead of prorating, they pay in full, according to the sharing guidelines. If incoming funds are lacking, payment takes longer.

It also means they paid the $9 million dollar shortfall from December first in January, then January’s shortfall first in February. A cause for significant concern is more likely just a shortfall that hasn’t yet been offset by a monthly surplus to catch up.

Even with expenses paid on a rolling basis and December’s shortfall, average payment times are sitting at 45 days. That’s on the shorter end of what’s normal in the insurance business. Currently, $9.6 million in expenses sit in the queue. For April, the numbers seem to be roughly lining up as far as what’s eligible and actually shared.

That’s good news of course. If we’d been on track for the $200/month member contribution to only cover about 2/3 of the expenses, the pool would need to either cut benefits by 1/3, or raise the monthly contribution to $300. At least for now, it seems that isn’t necessary.

HealthTrac

I’ve mentioned the HealthTrac program a couple of times before. It’s the health coaching system that Liberty uses for people who fall short of their health targets when joining. It helps overcome lifestyle issues that they’ve identified as being contributors to higher medical expenses–namely smoking and obesity.

My dad fell into this program when my parents signed up, and he still hasn’t “graduated”. But he has definitely lost weight, and quit the Mello Yello habit. Honestly, he has probably had one of his best years of general overall health improvements.

I can’t be sure whether the $80/month he pays for that program is responsible, or if it’s the actual coaching. But it is working.