I thought I was going to give just a quick update today, adding in June’s health sharing numbers from Liberty. Last time, I talked about some new reporting from Liberty, and the financial health of the sharing network taking that into account. But with the second month of the new reporting format, along with audited financials for 2017, I figured it was time for a more detailed look.

We’ll go over May’s numbers, and look at growth in the health sharing network and how they process claims compared to traditional insurers.

Just a reminder: I’m a Liberty member, not their agent. You’re getting my analysis and opinions, not theirs. It’s not right for everyone, and there’s risk (like with any insurance) that you need to understand.

Monthly Health Sharing Update

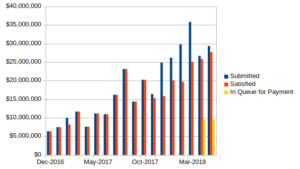

This part is pretty straightforward, but there are a couple of things worth noting. First, this is the second month with the new breakdown, showing expenses in queue for payment. This number is essentially unchanged, and suggests that we’re not at a point where we’re “catching up”, but also not “digging deeper.” Second, you can see that both submitted and shared/satisfied expenses are up, basically making 6 months following that trend.

A little bit of regression (i.e fitting a line to the data), and extrapolating out to the end of the year, we could expect over $40 million paid out just in December, and about $400 million for the calendar year. That’s small compared to the big five health insurers that collectively insure over 125 million people, but still a significant amount of money flowing in and out.

Significant Growth

As I was updating my spreadsheet where I compile all of the data from the monthly newsletters, I couldn’t help noticing how much the dollar figures have grown. December 2017 paid out almost $16 million, compared to just over $6 million for the same month in 2016. That’s two and a half times the sharing!

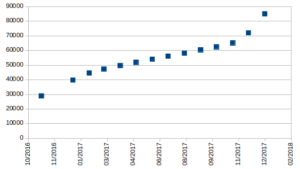

That begs a look into how much membership has grown. If membership were constant, those figures would be an indication that costs were skyrocketing and rate increases would be forthcoming. However, the year-in-review presents essentially the opposite. Membership growth has been insane.

Take a look at the chart above. It’s compiled from annual updates and the 2017 Year-in-Review publication from Liberty released this spring, and a video update a year prior. The first thing you notice is the dramatic increase over just a few months at the end of 2016–adding to its membership by 37% just in November and December. In 2017, membership more than doubled–going from just less than 40,000 households to over 85,000.

Bill Processing Times

I don’t know how many people Liberty started the year with processing bills, but it would be reasonable to assume they’ve doubled their staffing (or are in the process) during the last year. That’s pretty serious, and I’ll give them something of a pass when I read the occasional review that complains about response times. I’ll give them a little more credit for coming right out and saying they aren’t satisfied with processing times, early on in calendar year 2017. It wasn’t buried in some big financial report either–it was front-and-center in the monthly newsletter.

Even then, those “slow” processing times were on the order of 2 months, which is pretty good when compared to most insurers. Liberty tries to be better, and sits at 45 days for the second month with a 30-day target.

They don’t publish a breakdown of the number of individual members as compared to couples and families, but they do show that for the 85,121 household members (which includes individuals), there were 204,290 individuals in the health sharing system. That means 108,794 net new people during 2017, each with a medical history questionnaire reviewed, membership cards produced and mailed, online accounts set up, etc. It’s not a small undertaking, especially when compared to the total membership going into the year.

Is Health Sharing More Efficient?

With the data available, we can figure the annual amount of expenses submitted/shared per household. Again, we don’t know the breakdown of single, couple, and family members, so we’ll look at a couple of bounding cases. For 2017, members submitted $234 in claims per month per household. If all of those are members on the top-tier plan, and all are individuals between 30 and 65, that would be more than the $199 per person paid in, and more than the $175 used for sharing each month. However, we also know that the ratio of individuals to households held steady at 2.4. In other words, there are 2.4 members per plan enrollment on average.

If we assume that all of the enrollments are couples between 30 and 65, paying $299 each, with $275 available for sharing, the numbers are much better, showing an excess of $41 per plan per month. We know there must be some family plans to get the average to 2.4, and if all were family plans there would be a significant excess collected. The takeaway though is that the numbers look pretty good, given a reasonable mix of the three types of members. The year-end financials show a reasonable balance between sharing contributions and disbursements. Approximately $1.5 million in the sharing account was carried over into 2018.

What’s the average per-person contribution?

Since the ratios of households and individuals were constant year-to-year, I’m going to assume the same holds true on a monthly basis. It’s not perfect, but without additional membership data, the best that’s available.

Doing this, we have an average membership over the year of about 141,000. Given the $178.4 million contributed to the share accounts, we see that each member contributed approximately $105 per month, and when adding back the administrative costs, we see that each person pays, on average, $135.35 per month. For 2017, on the individual market, that same figure was over $400!!!

Claims Payment

The ACA report linked isn’t clear whether the claims figure is paid or filed, but let’s assume for a minute that’s claims for eligible stuff that’s paid out. Those policies are paying on average about $325 per month in claims, compared to $108 with Liberty.

There could be several reasons for the difference–the ACA plans could cover services that Liberty doesn’t (which we know is true for certain things), pay more for the same services, or people are simply consuming more services. But regardless of which is true, those ACA plans are collecting about $85 per individual that isn’t paid out, every month, compared to $27 for Liberty. On a percentage basis, those rates are pretty similar, suggesting at first that there isn’t anything revolutionary about the claims processing with Liberty.

But remember that Liberty doesn’t operate within a provider network with pre-negotiated prices. They let you use any provider, and negotiate on your behalf when billed and/or negotiate upon acceptance of your Liberty card. That flexibility on the patient’s part would seem to carry extra cost. Liberty needs to negotiate to get a reasonable rate for your services, and has no guarantee that a provider will negotiate at all. That could be time consuming, or result in Liberty paying more for the same service than one of the big five.

You, as patient, have the option of seeing a more expensive provider, that wouldn’t have been “in-network” with a traditional plan. But you also know that you have the option of shopping around yourself for a better deal, and that the amount of money available to pay your bill is fixed, and that payment isn’t guaranteed. It would seem that a combination of Liberty negotiating and patients being more cost-conscious pays off in some manner.

Negotiated or Ineligible?

Is Liberty denying claims in some capacity to make those numbers work? Are they effectively negotiating? Are they saying that parts of bills are simply excessive, leaving the patient to pay the balance? It would seem the answer is a pretty convincing no.

Members submitted $428 million in bills in 2017. That total was negotiated down by more than half, with providers discounting over $220 million. That leaves $171 million met through sharing, and $36.8 million (or 9%) not shared. The not shared portion is both ineligible expenses and expenses used to meet the annual unshared amount.

Let’s look closer at the $36.8 million that was ineligible or used to meet the AUA. We can divide by the average 2017 membership to see that it amounts to $260 per person per year. Remember that the AUA is $500 per person, $1000 per couple, and $1500 per family. Ineligible expenses appear to be a vanishingly small portion of claims. I feel a lot better about the odds of them covering my bills in full.

Reaching out to Liberty…

As you can see, there are a lot of places where more granular data would be nice. I’ve reached out to Liberty to see if they’ll release more data. I’d like to see breakdowns of plan enrollments, more detail of membership growth, and how they staff claims processing. I’ll certainly report back when I know more. But the more I research, the more likely it is that I’ll continue my health sharing participation.

Your thoughts?

One Comment Add yours